Get Started Today. Fill Out The Form For Access.

An opportunity for income-driven investors

The Multifamily Income Fund I offers accredited investors access to a portfolio of stabilized, cash-flowing multifamily properties across key growth markets.

With targeted returns of 9%, 10%, or 11% preferred monthly distributions and 6% accrued interest upon exit, this fund is designed to deliver both stability and strong performance.

No fees are charged to fund investors—your capital works entirely for you. Plus, our focus on properties with tax abatements ensures excess cash flow and supports affordable housing initiatives.

Capitalize on a once-in-a-decade opportunity

WHY PREFERRED EQUITY?

In 2023, the Federal Reserve implemented rapid interest rate hikes at an unprecedented pace to combat inflation. This dramatic policy shift disrupted markets, creating widespread dislocations, increased financial strain, and the risk of a global liquidity crisis.

At the same time, these factors have converged to create what we believe to be one of the most compelling opportunities for credit investments in decades.

What is preferred equity?

Preferred equity, or private lending, is a specialized asset class that includes loans, fixed-income investments, or other structured opportunities designed to offer higher yields with lower risk compared to equity investments. Through the MF Income Fund I, investors participate as lenders, providing capital to real estate deals in exchange for a fixed rate of return—often realized as a preferred return—without equity ownership or exposure to market volatility.

Unlike publicly traded fixed-income investments such as bonds or asset-backed securities, private credit investments are illiquid, which allows them to deliver higher relative returns. By focusing on private credit opportunities within the multifamily real estate sector, MF Income Fund I provides a stable and predictable income stream while prioritizing capital preservation for its investors.

2,836

Residential Units

17

Different transactions

Building off of experience

While this strategy has been refined to align with the current environment, it is built on a strong foundation of experience. Since 2014, we’ve acquired and operated over 2,836 residential units worth over $316M.

Consistent Income Potential

The fund is designed to deliver steady cash flow to investors through preferred returns, ensuring reliable income throughout the life of the investment.

Risk-Adjusted Returns

With a focus on preferred equity investments, the fund prioritizes downside protection while offering competitive returns in a dynamic market environment.

Experienced Management

Backed by a proven track record, the fund leverages years of expertise in multifamily investments to navigate opportunities and deliver strong results for investors.

A compelling choice for accredited investors

We anticipate closing on the fund’s first deal before the end of the year, with monthly cash flow distributions starting soon after. Don’t miss this opportunity to secure your spot in Multifamily Income Fund I and begin building consistent, high-yield returns.

First Acquisition

We aim to close on the first multifamily deal before year-end, establishing the foundation for strong cash flow.

Monthly Distributions

Once the first deal closes, you’ll start receiving consistent monthly cash flow, complemented by accrued interest payouts at capital events.

Three-Year Exit

Our plan is to exit in three years, capitalizing on a constrained supply environment that supports higher rents and increased valuations.

The Tailwinds

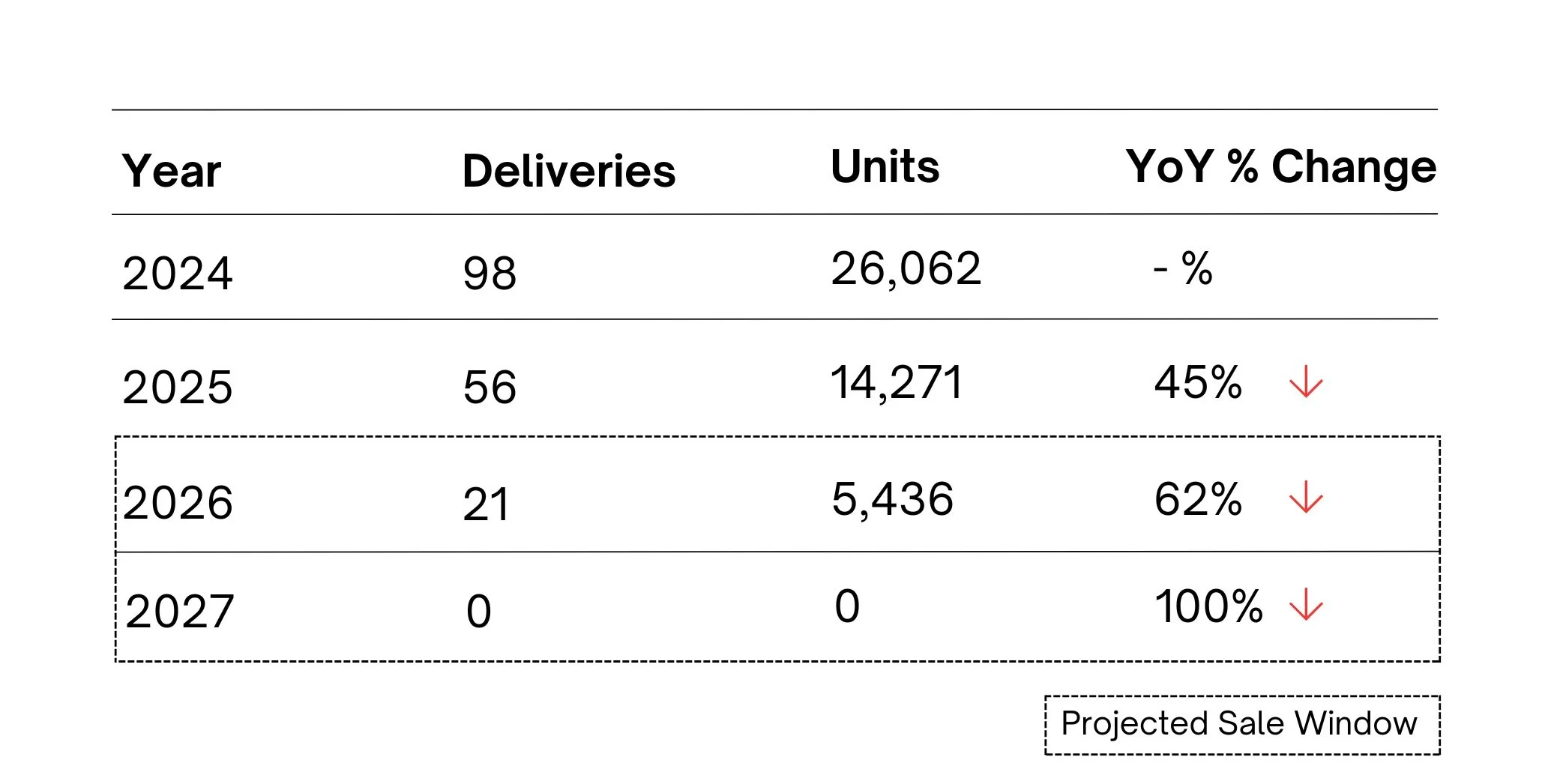

Houston's multifamily market is poised for significant shifts as new supply tapers off dramatically over the next few years. In 2024, the market will see 26,062 units delivered, but this number will sharply decline to just 14,271 in 2025—a 45% drop year-over-year. By 2026, new deliveries are expected to plummet even further, reaching only 5,436 units, representing a 62% decrease compared to 2025.

This constrained supply pipeline is primarily driven by rising interest rates and stricter lending requirements, making it more challenging for developers to bring new projects to market. As demand for housing continues to grow, these supply-side challenges create a favorable environment for rent growth and higher property valuations.

Data courtesy of RealPage Publications: Pipeline Deliveries Houston, The Woodlands, SugarLand, TX as of November 2024

Disclaimer:

This is a 506(c) offering available exclusively to accredited investors as defined by Rule 501 of Regulation D of the Securities Act of 1933. All investments are subject to risk, including the loss of principal. Past performance is not indicative of future results, and there is no guarantee that the investment objectives will be achieved. Potential investors should carefully consider the offering’s Private Placement Memorandum (PPM), including risk factors, fees, and conflicts of interest, before making any investment decisions. This material does not constitute an offer to sell or a solicitation of an offer to buy any securities, which can only be made through the PPM.